When it comes to tea and coffee, Asia is a dynamic hotbed of innovation and growth. To find out more, 1750 sat down with Mote Pooley, the Commercial Director for Finlays Asia and Chief Operating Officer of Damin, a joint venture between Finlays and Damin’s Founder and Chairman Mr. Jiang Aiqing

1750: Thank you for joining us Mote, please tell us more about you.

MOTE: I come from a mixed English and Thai family background, and during my childhood I was fortunate to be able to spend time in both the West as well as the East (where my family was based, firstly in Singapore, followed by Hong Kong). I have been based in the Greater China region since graduating. After joining John Swire & Sons in 2006, I have worked in Swire Pacific’s Beverages division with Swire Coca-Cola as well as in the Aviation division with the HAECO Group. In October 2021, I was honoured to have the opportunity to take up my current roles with Damin and the Finlays Group.

For readers who aren’t aware, can you briefly introduce Damin as a business?

Damin is one of the world’s leading suppliers of tea, coffee and botanicals extracts. It offers a wide and growing range of product categories, and our products are supplied from three manufacturing sites, with two plants located at our Zhangzhou headquarters (Fujian province), and one other plant located in Nanjing (Jiangsu province). Finlays’ strategic partnership with Damin dates back to 2011, when Finlays first took a minority shareholding.

Since then, the partnership has steadily strengthened and flourished through close collaboration across the group to develop a unique portfolio of products to serve our customers around the world.

What are some of the most notable dynamics in natural beverages in Asia at the moment?

Accelerated by the Covid-19 pandemic, a key trend is the growing demand for functional and nutritional benefits, as consumers place greater priority on healthier lifestyles and quality of life.

For example, beverages that boost the immune systems or aid digestive health. In general, the market is seeing a tremendous level of innovation activity across category, format, function and flavour, as brands seek to carve out winning propositions to capture these emerging new opportunities. Here at Damin, our R&D teams are busy working on initiatives in these areas to help our customers develop the right products to meet these needs.

Are there any particular trends in China you think will land in the West before too long?

Chinese consumers have been very quick to embrace and adopt digital platforms in recent years and e-commerce has revolutionised theretail landscape, with new formats such as livestreaming, in particular, accelerating the online shopping trend. China now accounts for more than half of the world’s total e-commerce sales. It’s inevitable we will see similar trends take further hold in the West, as digital platforms, tools and technologies continue to evolve, and companies seek out new avenues for creating value and engaging with consumers.

Tell us about what’s happening in tea in China at the moment.

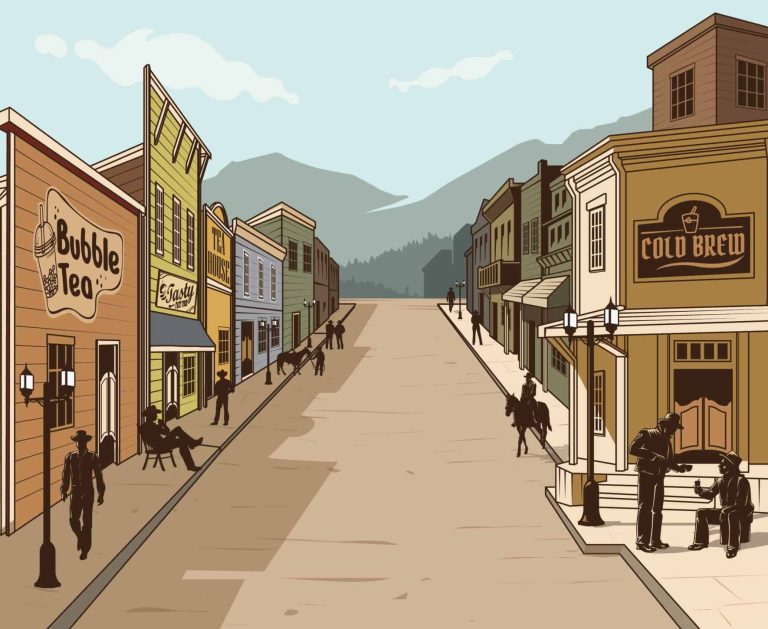

As the world’s largest producer and consumer of tea, China is obviously a vast and mature tea market comprising many segments. Key trends include health and wellbeing, no/low sugar RTDs with fruit flavours, and specialty fresh tea shops such as a milk tea/bubble tea are surging in popularity driven by younger consumers seeking innovative flavours and novelty or fusion concepts.

And what about coffee?

With Chinese coffee consumption continuing its sharp growth of recent years, it’s a very exciting time to be involved in this segment. As just one illustration of this, the number of coffee shops in Shanghai has increased to approximately 7,000, one of the highest numbers in the world, and far more than are currently found in other coffee loving cities such as Tokyo, London or New York.

Key factors behind the coffee boom in China include the tastes of the younger millennial/ Gen Z generations, as well as the fast-growing middle-class consumer segment with higher levels of disposable income. These consumer segments also have increased appetite for ‘trading up’ to more premium offerings, with higher-grade ingredients or innovative flavour combinations.

As coffee consumption is still relatively new and yet to penetrate beyond urban areas and younger generations into the wider population (at only around seven cups per year currently, China’s per capita consumption is much lower than in Europe, North America or Japan), there is considerable scope for the coffee market in China to grow significantly for many years to come.

Damin is achieving strong growth through a focus on “Original Equipment Manufacturing” (OEM) and “Original Design Manufacturing” (ODM). What do these mean for Damin?

At Damin we define OEM and ODM as being a one-stop-shop solution provider. Having built our OEM/ODM capability over recent years, this means we can now offer our customers fully-finished consumer products. That’s to say, in addition to our existing core business of ingredients supply to food and beverage industry players, Damin also supports customers with a range of services to supply final products for retail as well.

Depending on each customer’s specific requirements, this may range from a straightforward contract pack manufacturing service to a wider suite of services leveraging more of Damin’s capabilities, such as R&D and ingredients supply.

Underpinning our expansion into OEM/ODM services is the firm belief that, with the extensive range of capabilities and expertise that Damin continues to invest in and develop (from R&D through to manufacturing capabilities), we are ideally positioned to offer our customers greater value through a wider range of services that can help them more successfully realise their own strategies and objectives.

What does the future hold for Damin?

It’s a tremendously exciting time in our industry, and the future holds many new opportunities as consumer trends, market dynamics and technologies continue to emerge and evolve. Here at Damin, we are keen to continue to develop our capabilities and explore new models of collaboration with customers and industry partners in order to best capture those opportunities and create more value together.

For more insight and opinion on global beverage trends, download the latest version of 1750